We are a respected and reliable partner for banks, investment companies and institutional (hotel) investors. As such, we analyse and evaluate distressed hotels as well as hotel portfolios regarding going concern.

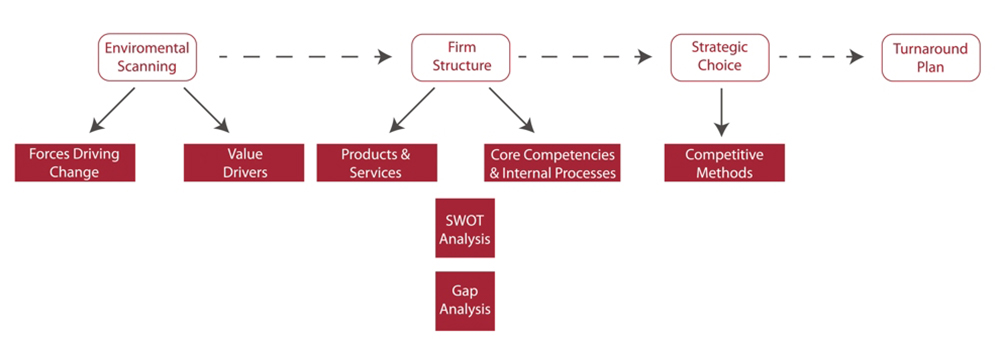

We evaluate location and general condition, analyze operational strengths and weaknesses (SWOT analysis) and create a turnaround plan that allows future potential to be exploited in the best way possible. Thus, the reasons for the operational deficits are identified and a proposal is drafted if and how the hotel can flourish in the future in order to contribute a solid and continued capital service.

In the valuation of hotel portfolios, recommendations are made for portfolio streamlining or restructuring. Market overheating or sector-specific difficulties may require adjustment in order to achieve set return targets in the long term.

Our major goal is to re-position the hotel and to implement structures and leadership strategies according to international hotel company standards. This is vital in order to ensure a sustainable increase in value.

Where we make a difference: We do not only consult but actively implement the developed concepts in interim management through our expanded head office structure. We introduce the turnaround measures together with the hotel team on site. In doing so, we serve all hotel-specific relevant disciplines from operations, construction, technology, IT, HR, finance, data protection, insurance and legal. This unique selling point distinguishes us and is a real added value compared to traditional consultants.

We have extensive experience in turnaround management which includes taking over distressed assets at short notice. More than 20 distressed hotel properties from various sectors were successfully restructured and repositioned.